"In the summer of 2000, I asked a group of 100 people at a conference of spiritually committed people who would push a red button if it would immediately stop all narcotics trafficking in their neighborhood, city, state and country. Out of 100 people, 99 said they would not push such red button. When surveyed, they said they did not want their mutual funds to go down if the U.S. financial system suddenly stopped attracting an estimated $500 billion-$1 trillion a year in global money laundering. They did not want their government checks jeopardized or their taxes raised because of resulting problems financing the federal government deficit. Our financial profiteering and complicity is not limited to aristocrats and the elites who do their bidding. Our financial dependency on unsustainable economics is broad, ingrained and deep."

~Catherine Austin Fitts, Dillon Read & Co. Inc and the Aristocracy of Stock Profits

Table of Contents

I. Introduction: The Power of Shunning

II. What Is ESG?

III. Why Is ESG Important to You?

IV. Recent Growth in ESG

V. Toward a Coherent Vision for ESG

VI. An Example: JPMorgan Chase & Co.

VII. Turning the Red Button Green

VIII. ESG: What Should You Do?

IX. Conclusion

I. Introduction: The Power of Shunning

"Monsanto can do anything they want to you, and put anything they want into your food. There's nothing you can do about it."

~Gov. Jesse Ventura

It was a beautiful spring day in 2010. I was having lunch with a money manager in Zurich. Schooled in Austrian economics, he understood the deterioration of the legal and financial systems in the United States. He focused on investing his and his clients' family wealth in real assets—whether in precious metals or companies that produced enduring value and dividends. He wanted to know if any of my clients would be interested in his fund.

The answer was no. The fund held an investment in Monsanto. The money manager was taken aback—he did not engage in "socially responsible investing" (SRI). I explained that this had nothing to do with SRI. This was a cultural phenomenon—a deep fury against centralizing trends for which Monsanto had emerged as the poster child. These trends included:

- Efforts to patent seeds, corrupt the seed supply, and control the food supply through genetically modified organisms (GMOs)

- The use of "substantial equivalence" to achieve regulatory approval for untested GMO products and technologies, resulting in widespread experimentation on uninformed humans

- Intrusive and expensive political lobbying and public relations to force regulators in Europe, Asia, and Latin America to accept GMOs and nanoparticles in their food supply

- Use of foreign aid and disaster capitalism to introduce GMOs in foreign war zones and disaster areas, with dramatic impacts on local farmers and agriculture

- Political targeting and firing of scientists whose research indicated serious problems with GMOs

- Increased presence in the food supply of glyphosate via pesticides, GMOs, and engineered nanoparticles—and strong correlations of glyphosate with rising rates of chronic disease

- Aggressive lobbying to change state laws to mandate "terminator" seeds (seeds genetically engineered to be sterile) and prevent farmers from saving and using their own seed

- Rumors of mercenaries in black vans arriving in the dark to assault farmers who resisted conversion to terminator seeds

- Entrapment of and lawsuits against farmers whose fields were corrupted by GMO drift from neighboring farms (such as Percy Schmeiser)

- Sabotage of labeling law efforts, making it expensive and difficult for consumers to differentiate between food and "Frankenfood"

- The suicide of 200,000-plus farmers in India that stalled the World Trade Organization's Doha Round and efforts to industrialize agriculture globally

My clients' rage was not the expression of a desire for socially responsible money management services. It reflected the desire of intelligent people not to spread a corporate disease that was draining time, health, and finances in their daily lives. At the deepest level, their aversion to investing in Monsanto shares reflected an intuitive understanding of biophysics—they wanted no energetic connection with something this repulsive.

Some would assume that investment by this particular money manager in Monsanto reflected either a deep ignorance of how the world really worked or a deep hypocrisy in his stated values. For many investors, the only thing worse than a hypocritical money manager is a clueless money manager. In this instance, the money manager looked into the matter and ultimately sold the fund's position in Monsanto.

It turned out to be a wise investment choice. The backlash against GMOs and glyphosate ultimately pummeled Monsanto's market and stock price. That backlash is now doing the same to the German company that purchased Monsanto, as U.S. civil litigation and judgements against Monsanto slowly reflect the reverberation of an anger that continues to grow. We see a similar trend having an impact on opioid manufacturers, as companies such as Johnson & Johnson are hit with large jury awards, and companies such as Teva Pharmaceutical agree to expensive settlements rather than risk a jury trial.

Laws protecting pharmaceutical companies from liability and requiring the American taxpayer to fund victim compensation are protecting vaccine makers in the United States—for now. However, the fury rising as a result of the autism and vaccine injury epidemics, and the efforts to politically mandate vaccine schedules that have exploded in size since corporate liability was waived, will eventually punch through—one way or another. So will the anger directed at the use of "fake science," abetted by a corporate media that is heavily funded by pharmaceutical advertising.

Ultimately, our adoption and maintenance of values and the application of those values to the institutions and activities around us are cultural. No system of laws and rules can enforce what is not inherently integrated into our beliefs and daily actions. Nor can a system of laws and rules that is out of alignment with our values ultimately endure.

This is why a healthy culture does not need lots of laws and regulations—nor an expensive infrastructure of police, prosecutors, and courts to enforce them. In a healthy culture, everyone understands and shares the group values and does their best to behave productively. Pressure on those behaving unproductively is immediate and happens in our daily lives. Historically, shunning has been one of the most powerful and effective tools to exert this pressure—and explains why transparency of government and other shared resources in combination with free markets can make such an enormous difference.

Consider how the climate change debate keeps being distilled down to the personal behavior of those promoting climate change action. If someone believes in climate change, why are they flying around in a private jet? Why are they buying a $15-million-dollar mansion by the ocean?

For cultural values to work, and for those values to translate into effective shunning of people, products, and enterprises, we must be able to see what is going on around us and be free to exercise our choices in a marketplace. With the escalation in secrecy of central banks, government, and shared resources—and the efforts of centralized leadership to replace markets with technocracy—we are experiencing a rising level of corporate and investment monopolies and inequality. It is hardly surprising, then, that the leaders of those monopolies would seek to promote greater powers for themselves to define our values—and to use our savings (in the manner of their choosing) to finance the values they define for us.

Welcome to the explosive growth of environmental, social, and governance (ESG) investing—where technocracy and capital controls collide with our savings and use of resources in the push for ever greater central control.

ESG, as currently promoted, is a mechanism that Mr. Global is using to integrate technocracy into investment and corporate operations. It is a clever effort to hijack the instinct to shun before it does damage to centralized systems. However, with some spiritual and cultural judo on our part, it is also a mechanism that we can use to integrate our values and our investments. It can be used to extend the Golden Rule—"do unto others as you would have them do unto you"—to also mean "finance unto others what you would have them finance unto you."

Oh goodie—another powerful escalation in the battle with Mr. Global for the soul of the planet! Can we take responsibility to lead in a more positive direction while facing and managing the real risks before us? Here goes!

II. What Is ESG?

"[The technetronic era] involves the gradual appearance of a more controlled and directed society. Such a society would be dominated by an elite whose claim to political power would rest on allegedly superior scientific know-how. Unhindered by the restraints of traditional liberal values, this elite would not hesitate to achieve its political ends by using the latest modern techniques for influencing public behavior and keeping society under close surveillance and control."

~Zbigniew Brzezinski, Between Two Ages: America's Role in the Technetronic Era, cited by Patrick M. Wood in Technocracy Rising: The Trojan Horse of Global Transformation

What is ESG? ESG stands for the environmental, social, and governance criteria increasingly being applied to corporate operations and investments. The stated goal is to ensure that companies are good citizens, with the implication that investors will hold them accountable if they are not. For the time being, ESG applies primarily to securities investment, although it is moving into private equity and real estate as well.

Our 3rd Quarter 2016 Wrap Up: Investment Screening: Can We Filter for Productive Companies? provides an overview and history for those who are new to this area of investment criteria and screening.

3rd Quarter 2016 Wrap Up: Investment Screening: Can We Filter for Productive Companies? (PDF)

The Solari Report has a wealth of additional background information to help you understand ESG. One resource that I recommend in particular is our interview with Patrick Wood on technocracy. Here is our Just a Taste excerpt:

Centralizing forces are weaponizing ESG to implement technocracy. A key tactic is to encourage the numerous people who have legitimate concerns regarding the environment and inequality to support climate change initiatives with respect to investment. What does the ESG promotion of climate change initiatives achieve? Among other things, it is a way of marketing a radically lower energy and resource footprint in the face of pressures from a growing global middle class and from extraordinary monetary inflation created by the central banks. Climate change is also being used to build support for a global taxation system—a necessary step for building a global government operating with much greater levels of central control. Throw in transhumanism, and ESG becomes quite a powerful tool in the effort to override the rights of individuals, families, and communities and facilitate corporate ownership and control of land, real estate, and natural resources.

What ESG is not yet being used to do is to address the corruption of the most basic laws related to financial integrity and disclosure. It has not addressed the massive mortgage securities fraud that resulted in the bailouts or significant investor losses on Chinese securities (see the documentary The China Hustle). It has not addressed the U.S. Department of Justice targeting of U.S. rating agencies that took the step of downgrading the U.S. credit rating—S&P/McGraw Hill and Egan-Jones. ESG has ignored FASAB 56. If you have not read our 2018 Annual Wrap Up: The Real Game of Missing Money, please consider it essential reading to understand what the current application of ESG is all about. Start with "Caveat Emptor: Why Investors Need to Do Due Diligence on U.S. Treasuries and Related Securities."

If one of the primary goals of ESG is to express concern about the environment, ESG's disassociation from environmental basics is as profound as its disassociation from financial basics. It is unusual to find any mention of the impact of GMOs, nanoparticles, or other forms of experimentation on the natural world, insects, other species, or our food supply—or of the impact of nuclear testing, including in the upper atmosphere. Rarely, if ever, do I hear mention of global spraying, HAARP, EMF radiation, or the environmental impact of the U.S. and global militaries, which are now spending over $2 trillion globally according to official accounts (and much more, no doubt, in secret). Why are cows proclaimed more dangerous to the environment than a new arms race? The fact is, cows are not an environmental danger. Rather, controlling animal protein is a valuable spot on the global monopoly board. (See "An Intelligent Conversation about the Environment".)

If we were to portray the world of investment as a tree, ESG appears to be massively complexifying selected twigs, while ignoring the rotting in the tree trunk and roots. As the U.S. government systematically refuses to obey its own financial management laws, arranges for the presidents of rating agencies to be fired if they dare suggest there are credit problems, and essentially takes the majority of the U.S. securities market dark, the ESG world remains silent—all the while lobbying to add more complex non-financial disclosure regulations.

This begs the question: If you are not going to respect or follow the disclosure rules in existence, why layer on more rules? Is layering on more disclosure requirements a game of distraction? Is it another way to give large companies a competitive advantage through more regulations? Why does an emotional panic attack about climate change negate the need for basic accounting or an independent rating process?

The extent of the disassociation found in many ESG efforts is significant.

III. Why Is ESG Important to You?

"To many executives, the word sustainability is a cue to stop listening. One way to begin changing the perception of sustainability is to stop using the word."

~Lawrence M. Heim

You're busy—why should you care about the growth of ESG investing? After all, talk about sustainability and social responsibility has been putting busy people to sleep for decades. Here's why you should care.

First, technocracy—including weaponized ESG—is headed toward your home, workplace, and community in the form of a tsunami of micromanaging laws and regulations. If it does not eat up your time or destroy your business, it will certainly raise your expenses and cause dissension among those around you. This is a major wave—and you need to be prepared to navigate it. That starts by understanding it and exploring the impact that it may have on your individual situation.

Second, while large corporations and investors may be intent on weaponizing ESG, there is no reason that honest and ethical people cannot redirect ESG in a more positive direction. The ESG industry has attracted an impressive number of intelligent, capable data and financial analysts and money managers interested in providing services to investors who really do want to align their investments with their values. There is significant and sincere market capacity, interest, and demand. This is an opportunity to evolve our financial and investment systems in a direction that nurtures human civilization.

The goal of this discussion is to give you some ideas about how to do that. What's good for the goose can be good for the gander—so now is the time to get into the thick of things.

IV. Recent Growth in ESG

"The story of ESG investing began in January 2004 when former UN Secretary General Kofi Annan wrote to over 50 CEOs of major financial institutions, inviting them to participate in a joint initiative under the auspices of the UN Global Compact and with the support of the International Finance Corporation (IFC) and the Swiss Government. The goal of the initiative was to find ways to integrate ESG into capital markets. A year later this initiative produced a report entitled 'Who Cares Wins,' with Ivo Knoepfel as the author. The report made the case that embedding environmental, social and governance factors in capital markets makes good business sense and leads to more sustainable markets and better outcomes for societies. At the same time the United Nations Environment Programme Finance Initiative (UNEP/Fi) produced the so-called 'Freshfield Report' which showed that ESG issues are relevant for financial valuation. These two reports formed the backbone for the launch of the Principles for Responsible Investment (PRI) at the New York Stock Exchange in 2006 and the launch of the Sustainable Stock Exchange Initiative (SSEI) the following year."

~ George Kell, "The Remarkable Rise of ESG"

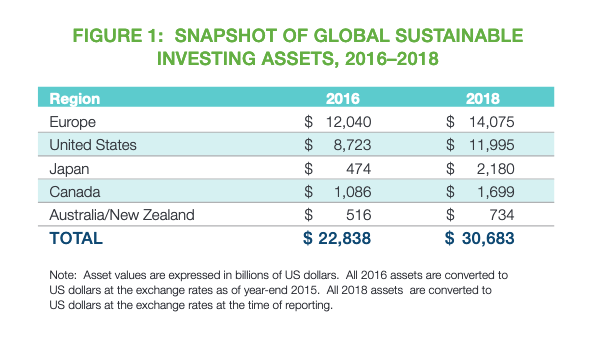

The Global Sustainable Investment Alliance is a collaboration of membership-based sustainable investment organizations around the world. It has published a Global Sustainable Investment Report every two years since 2012, including a report in 2018. The Alliance documents the growth of ESG investing in Europe, the U.S., Australia, New Zealand, and Japan and is tracking the development of such networks in Latin America and Africa. The Alliance does a valuable service by making its reports available to the public. You can access the 2018 report here.

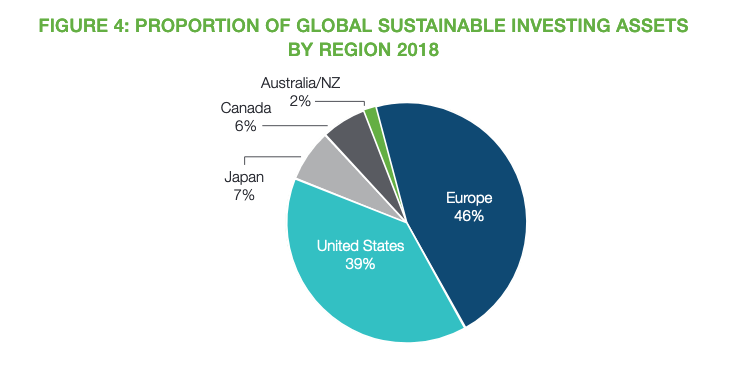

As described in the 2018 report, managed investment assets subject to ESG criteria have grown 34% from $22 trillion to $30 trillion.

Europe continues to maintain the highest percentage of assets subject to ESG criteria.

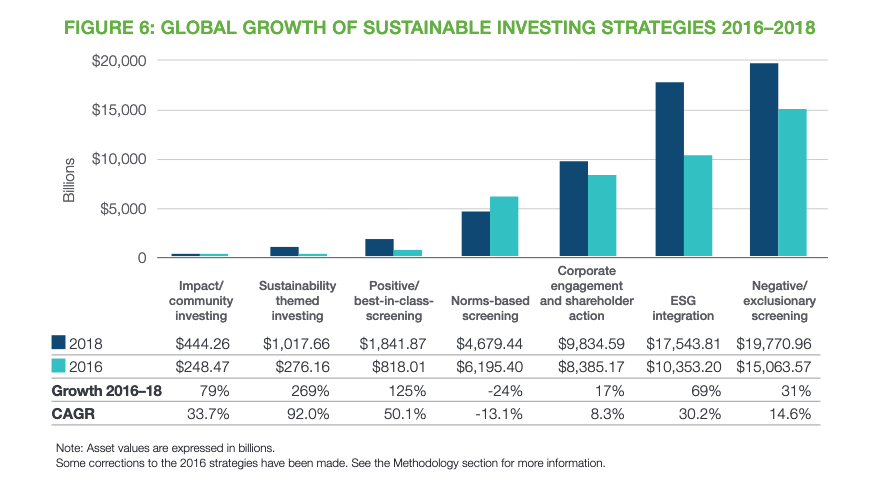

Almost all types of application strategies reflected growth during the period.

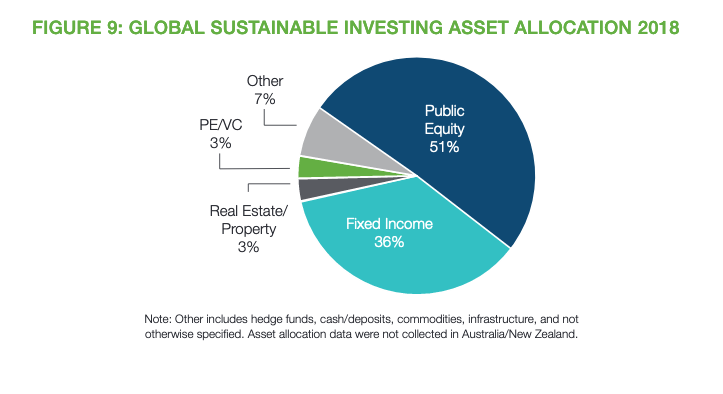

The leading application of ESG criteria continues to be in the equity markets. However, significant fixed income assets are also subject to ESG criteria. To date, real estate subject to ESG criteria is relatively small; it will be interesting to see how that changes as more real estate securitizes through global REITs and other publicly traded investment vehicles. (For more on growth in publicly traded real estate, see our 3rd Quarter 2018 Wrap Up: Megacities and the Growth of Global Real Estate Companies.)

Numerous regulators and industry associations continue to encourage the use of ESG. Their support for ESG is steadily growing at the very time they are failing to address a steady deterioration in compliance with financial laws and traditional standards of accounting and disclosure related to governments and corporations as well as the securities market. Watching the evolution of ESG, one wonders if this is not a campaign in complexity as “whiteout.”

In 2014, the European Union adopted a directive requiring large companies (approximately 6,000 listed companies, banks, insurance companies, and other companies designated by national authorities as public-interest entities) to provide non-financial disclosure on environmental, social, and employee responsibility, human rights, and anti-corruption and bribery matters. This occurred in the same year that Dutch auditors claimed that NATO members could not determine how their funds were being spent in the annual $1 trillion of NATO spending, indicating that NATO's expenditures were largely classified. This appears to be another example of ignoring the failure to comply with existing financial disclosure standards while creating additional non-financial disclosure requirements.

After all, if something is not working, then just require more!

In 2015, the Paris Climate Agreement included a commitment to make financial flows consistent with a lower carbon world and sustainable development. However, President Trump snatched the United States from the jaws of that commitment in 2017, much to the dismay of the financial interests keen on global taxation.

In fiscal 2015, the U.S. federal government was missing $6.5 trillion in accounts at the Department of Defense (DOD) and $278.5 billion at the Department of Housing and Urban Development (HUD). (See documentation at https://missingmoney.solari.com.) During 2015, the U.S. Department of Labor (DOL) confirmed that incorporating ESG into investments is compatible with fiduciary duties under the Employee Retirement Income Securities Act (ERISA). DOL has said nothing, to my knowledge, regarding continued purchasing of Treasury securities by pension funds and retirement accounts—or the securities of related banks and IT contractors—despite the possibility that significant funds may be illegally leaving federal accounts through the back door and despite bullying of rating agencies to ensure that U.S. Treasury and related securities maintain high investment grade ratings.

As of 2017, signatories of the United Nation's Principles for Responsible Investment (PRI) have grown to more than 1,750 from 50 countries, representing approximately $70 trillion. The UN launch of PRI in 2006 coincided with the takedown of the U.S. mortgage bubble and the beginning of the financial crisis.

Recently, the EU published new requirements for managers of large asset pools, who must publish their policies on the integration of sustainability risks into their investment decision-making process by 2020. Asset and fund managers will be required to have sufficient resources for the assessment of sustainability risks. Remuneration policies will be tied to sustainability targets. Investment policies and documentation will need to be reviewed and amended.

During this period, the private sector also contributed mightily to the complexification process.

The Sustainability Accounting Standards Board (SASB) was founded in the United States in 2011 to develop additions to the accounting principles used in financial reporting in the U.S. A review of the Board's founders and leadership makes the reader wonder to what extent this was funded by a teeny-weeny reinvestment of the lush profits enjoyed by those founders and supporters as a result of the mortgage bubble and the subsequent bailouts that cost the taxpayers $24+ trillion. Most of those trillions had rolled into Wall Street by that time. There is no reference that I can find in the Board's literature to the fact that the basic accounting standards had failed to the tune of $36 trillion—$24 trillion of bailouts and what was then approximately $12 trillion missing from U.S. government accounts. Again, the focus seems to be on further complexifying the reporting requirements rather than getting the traditional requirements to work.

It is not clear why the SASB founders wanted an alternative to the Global Reporting Initiative (GRI) originally founded in the United States in 1997. The GRI is now based in Europe and has become an international independent standards organization to help "businesses, governments and other organizations understand and communicate their impacts on issues such as climate change, human rights and corruption." Add the standard-setting involved at the PRI, the OECD, and a variety of other parties, and we have quite a collection of groups mapping out human and planetary ecosystems without any apparent interest in the collapse of traditional accounting standards or the explosive secrecy masking growing military and intelligence spending managed by large publicly traded corporations and banks.

On October 1, 2018, three days before the Federal Accounting Standards Advisory Board adopted Statement 56—with the approval of both the Government Accountability Office (for the Congress) and the Office of Management and Budget (for the White House)—a group of large investors petitioned the SEC to develop ESG reporting requirements. Attorney Betty Moy Huber reported:

Investors Petition the SEC to Develop ESG Reporting Requirements.

"A group of investors representing more than $5 trillion in assets under management petitioned the U.S. Securities and Exchange Commission on October 1, 2018 to develop a comprehensive framework that would require public companies to disclose environmental, social and governance (ESG) aspects relating to their operations. Petitioners include CalPERS, the New York State Comptroller and the U.N. Principles for Responsible Investment. The 19-page petition, available here, cites increasing demands by certain investors for information to better understand the long-term performance and risk management strategies of public companies. The petition notes that the voluntary 'sustainability reports' that some companies have produced in response to these demands are insufficient and instead, an SEC-mandated comprehensive framework for clearer, more consistent and more fulsome, reliable and decision-useful ESG disclosure (above and beyond existing SEC disclosure requirements) would meet this demand. The petition does not lay out a framework for the SEC to consider other than a suggestion that the climate risk disclosure framework issued by the FSB's Task Force on Climate-Related Financial Disclosure could be used by the SEC 'as a starting point in promulgating its own Framework for comprehensive ESG disclosure.'

The petition comes on the heels of Senator Warren's September 14, 2018 bill, the Climate Risk Disclosure Act, which if passed, would require the SEC to issue rules requiring public companies to disclose climate change-related risks, including climate change scenario analyses similar to those called for by the FSB Climate Task Force referenced in the petition, as well as companies' direct and indirect greenhouse gas emissions, the total amount of fossil fuel-related assets they own or manage and their management strategies related to physical risks posed by climate change."

Not to be outdone by the indifference of Senator Elizabeth Warren (D-Massachusetts) and several of the largest pension funds in the United States to FASAB 56 and the federal government's decision to take the majority of the U.S. securities market dark, U.S. CEOs then went into high media gear in 2019.

First came the annual CEO letter from Larry Fink, the Chairman of BlackRock, one of the largest U.S. investment firms, touting long-term thinking and sustainability priorities:

"BlackRock's Investment Stewardship engagement priorities for 2019 are: governance, including your company's approach to board diversity; corporate strategy and capital allocation; compensation that promotes long-termism; environmental risks and opportunities; and human capital management. These priorities reflect our commitment to engaging around issues that influence a company's prospects not over the next quarter, but over the long horizons that our clients are planning for."

I have worked with BlackRock and am familiar with a few of the tactics they used to achieve a quasi-monopoly position in the asset management industry. So, I note their silence on the adoption of FASAB 56 and the failure of traditional accounting and financial controls to prevent massive mortgage fraud and a financial coup d’état. Plus ça change, plus c’est la même chose. ("The more things change, the more they stay the same.")

In August of 2019, the Business Roundtable, an association of CEOs of large U.S. companies, published a "Statement on the Purpose of a Corporation":

Statement on the Purpose of a Corporation

Americans deserve an economy that allows each person to succeed through hard work and creativity and to lead a life of meaning and dignity. We believe the free-market system is the best means of generating good jobs, a strong and sustainable economy, innovation, a healthy environment and economic opportunity for all. Businesses play a vital role in the economy by creating jobs, fostering innovation and providing essential goods and services. Businesses make and sell consumer products; manufacture equipment and vehicles; support the national defense; grow and produce food; provide health care; generate and deliver energy; and offer financial, communications and other services that underpin economic growth. While each of our individual companies serves its own corporate purpose, we share a fundamental commitment to all of our stakeholders. We commit to:

- Delivering value to our customers. We will further the tradition of American companies leading the way in meeting or exceeding customer expectations.

- Investing in our employees. This starts with compensating them fairly and providing important benefits. It also includes supporting them through training and education that help develop new skills for a rapidly changing world. We foster diversity and inclusion, dignity and respect.

- Dealing fairly and ethically with our suppliers. We are dedicated to serving as good partners to the other companies, large and small, that help us meet our missions.

- Supporting the communities in which we work. We respect the people in our communities and protect the environment by embracing sustainable practices across our businesses.

- Generating long-term value for shareholders, who provide the capital that allows companies to invest, grow and innovate. We are committed to transparency and effective engagement with shareholders.

Each of our stakeholders is essential. We commit to deliver value to all of them, for the future success of our companies, our communities and our country.

From Business Roundtable

Nowhere in the Business Roundtable presentation was there any mention of the serious criminal and civil violations committed by some of the financial institutions and companies represented on their board and membership—or of their extraordinary dependency on federal government spending and credit which, in turn, depends on missing money, bailouts, secret books (now institutionalized with FASAB 56), and skyrocketing debt. Indeed, some of the financial institutions represented by the Roundtable served as leading members and agents of the New York Fed—the depository for the U.S. government when the $21 trillion went missing.

Whatever has prompted public regulators and private companies and associations to issue these statements, there is little doubt that the rush of regulators and CEOs to get on board continues to fuel significant growth in non-financial disclosure regulatory requirements. It remains to be seen what the response of the retail investor will be, or of the many nations outside of the G7 areas of influence. But after several decades of explosive amounts of financial fraud and corruption, it is hard for experienced investors to be lectured to regarding "values" by the leaders of monopolistic enterprises, many of whom have been both perpetrators and beneficiaries of the fraud and corruption.

It's a bit like Tony Soprano lecturing his HUD mortgage fraud victims on the importance of their adopting a more modest lifestyle and learning to take better care of their neighborhood.

V. Toward a Coherent Vision for ESG

"Reality is that which, when you stop believing in it, doesn’t go away."

~ Philip K. Dick

A positive development regarding ESG is the increased availability of talented people interested in helping enterprises better understand their dynamic economic relationships in a manner that can improve risk management and productivity. One of the benefits has been an increased investment in the analytics software and data that can help. However, even with these improved tools, defining and applying ESG criteria is not as easy at it sounds. Critical issues include differences in values, maps of reality, and goals; the significant impact of negative returns in government and central banking operations (critical aspects of our existing economic and financial models); the growing pressure on resources; and the secrecy surrounding our planetary governance system.

People of different cultures and faiths have different values.

A Muslim or Buddhist would likely shun investment in liquor and wine companies, whereas I as a Christian would not, unless those companies depended on illegal tactics such as aggressive marketing to target underage children or the use of entrainment in their digital marketing campaigns.

Someone who practices Sharia law might object to banks that profit from usury. However, large U.S. banks have been instrumental in changing the usury laws and stripping normal consumer protections from student and consumer lending; their boards and management appear to be quite comfortable engaging in practices that were once illegal. The result is that the largest U.S. banks have a low cost of capital—thanks to taxpayer-supported credit—while the average American not only has an exceptionally high cost of capital but also bears the costs of bailouts, currency debasement, and the federal credit used by the banks. These same banks have expensive and glossy sections in their Annual Reports and on their websites regarding their commitment to social responsibility. They see no conflict; it's all part of "caveat emptor"—buyer beware. It is one of the reasons I sometimes wonder if the War on Terror is really just a "war on people with oil who oppose usury" to allow clever arbitrage and "debt control" to follow the smartphones globally without interference from religious or traditional values.

Ordinarily, differences in values are a problem that markets are excellent at addressing. Let every participant engaging with "other people's money" fully disclose their practices and let investors simply express their values with their choices in a free market—just as my former clients did regarding Monsanto.

The challenge comes when savings become highly centralized into professionally managed pools of capital. Professional investors are then left with the task of choosing sets of values with highly unique results. For example, a company that enjoyed rich profits from the mortgage bubble and related securities fraud—which resulted in trillions in bailouts, millions of foreclosures, and significant unemployment and bankruptcies—is deemed to be "women-friendly" because each year it hires a few dozen female graduates from Ivy League business schools.

The application of ESG criteria can get very complicated very quickly. If you—either as an investor or as a business owner—wish to apply ESG criteria, you first need to determine your values and what is important to you. That also means determining what is strategically important and what is not.

A former client of mine had a large deposit at a local community bank that had opened with a strategy centered on progressive values. The bank did a significant market research study on whether or not—and how—they could offer "green" products. The study’s results demonstrated that while many of their clients wanted green products, they would never fund the expense of providing them. In short, "green" was a style choice, but not an economic one.

This is one of the reasons I often tell the Red Button Story (see video at the top). Some of our values are relative. We don't want narcotics traffickers targeting children in our community. However, we will tolerate it to avoid our taxes going up or our government checks disappearing—or because we are afraid of offending the people who control the operations and the accumulated profits. We will vote for the politicians who provide us a cover story. "We are good [pick one: Americans, Catholics, Episcopalians, Jews, Muslims, progressives]. It is not us doing it. It is those bad people over there." A satisfying cover story combined with government largesse has been a winning political strategy.

Such tradeoffs are one of the costs of highly centralized systems. Different groups have different values, and each group engages in a multiple personality disorder between their stated values and the values they actually practice when they are asked to price out their willingness to compromise—both on a transparent basis and on a basis where good marketing supports their ability to pretend.

All of this makes defining and prioritizing our values complicated.

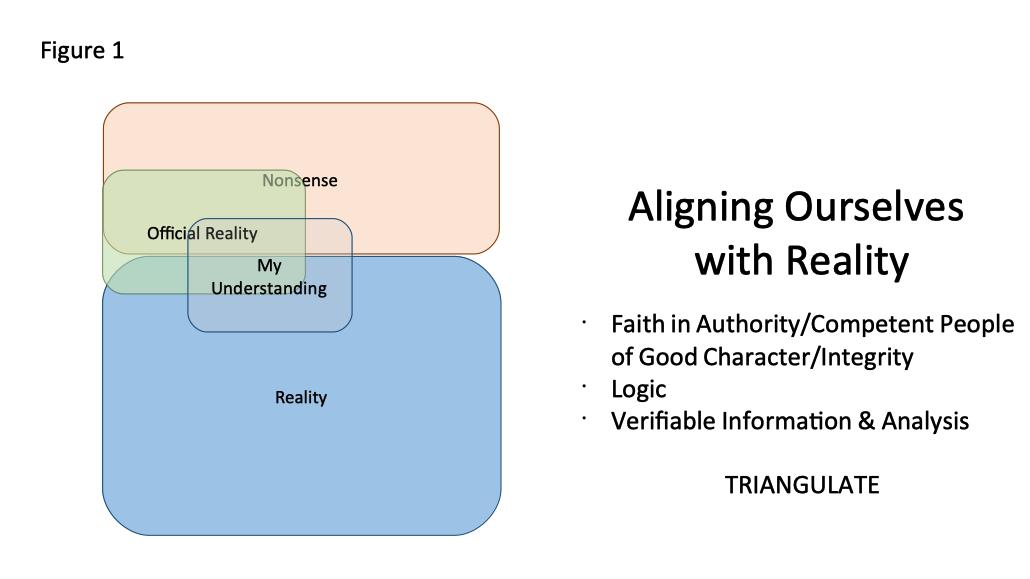

The second challenge in the application of ESG is finding a common understanding or "map" of reality. Often, disagreements about values turn out to reflect a difference in maps of reality.

The Solari Report recently published an excellent interview with Dr. Mark Skidmore called "Navigating Reality," which addresses the issue of operating in a world where perceptions of economic, political, and social reality differ significantly. The explosion in information technology and globalization, by its very nature, means that we have people with differing languages, experiences, education, and points of view colliding in what Michael Ventura once described as "the psychic storm of our own being."

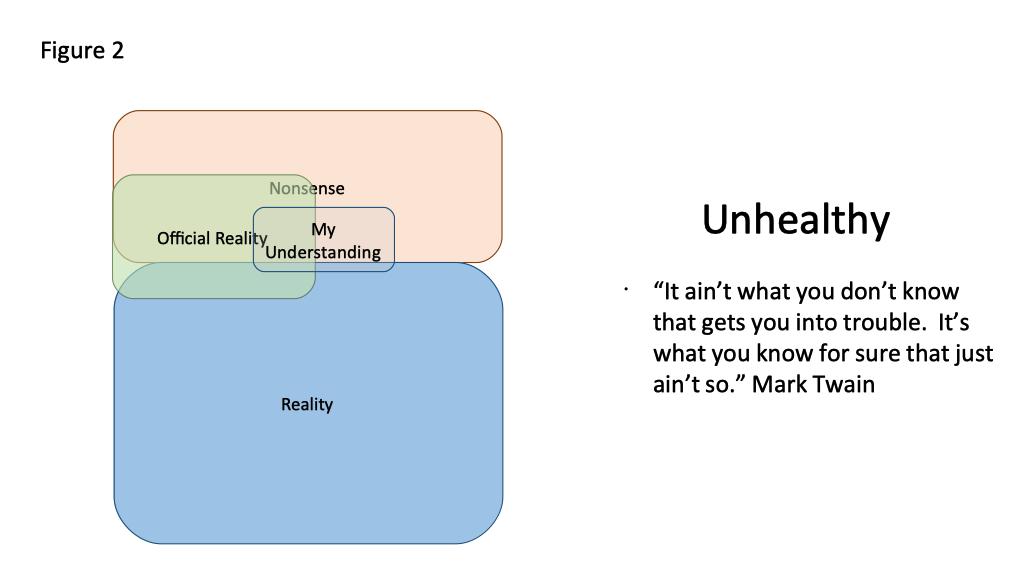

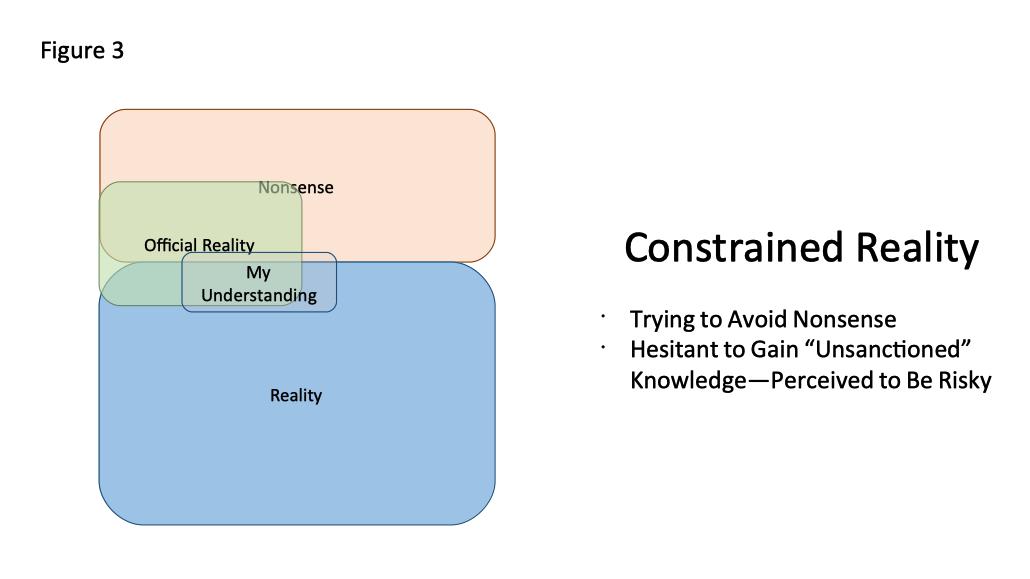

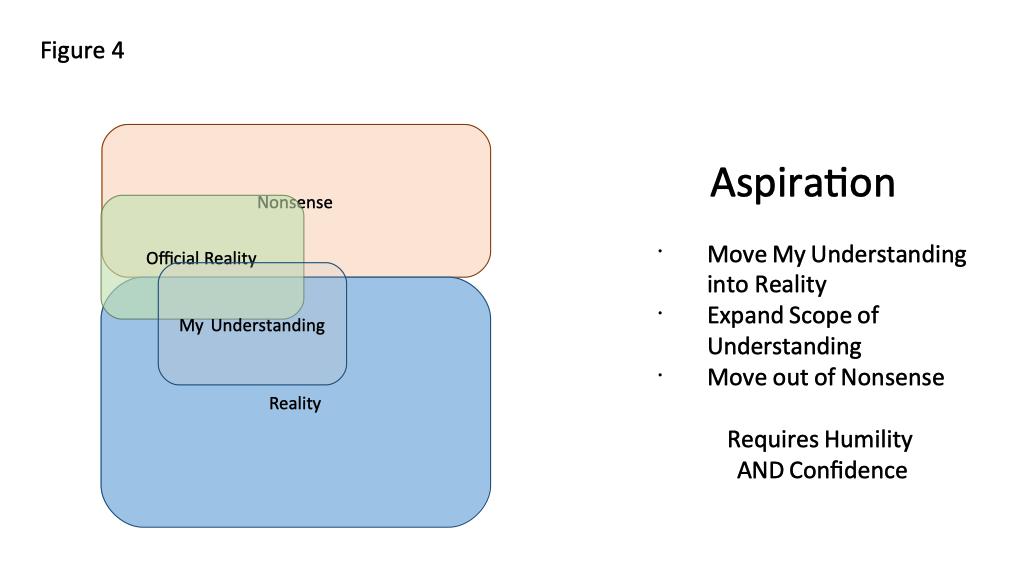

Dr. Skidmore used four graphics to show four possible maps of an individual's reality.

One of the challenges of building an accurate map of reality is that many of the most powerful systems used to govern and control are invisible. Monetary and fiscal policy, for example, has been used in the United States to engineer a wide discrepancy in costs of capital. A New York Fed member bank may borrow at 0%-2% using the federal credit, while it can charge the citizens who provide the backstop for such credit 12%-30%. Remarkably, many of the bank’s customers will not connect the dots because cost of capital is a relatively invisible phenomenon for most people.

Surveillance capitalism has been a source of great wealth for the tech industry and investors. However, most of the people who are surveilled do not "see" this happening to them. They do not see how others are compromising their privacy and intimate relationships to make money and build companies. They do not see how this surveillance and the related data harvest and manipulation are draining local economies and subverting their political impact broadly.

The widespread application of entrainment, subliminal programming, and mind control technologies along with significant investment in propaganda and distraction make it difficult if not impossible for many people to successfully navigate media and financial markets—particularly when they do not appreciate the existence of such technologies nor understand the techniques at play. The importance of mind control to the creation and maintenance of "official reality" is one of the reasons we chose Truthstream Media's The Minds of Men as our documentary of the year for 2018.

There are countless other examples of invisible factors—certainly many you have experienced personally. You will find significant attention given to these on The Solari Report. Superior intelligence on invisible control techniques can significantly improve personal productivity after you get over the initial shock of discovering that your existing map of the world requires a refresh.

Most ESG efforts are struggling to apply their criteria within one or more "official realities." As change accelerates, reality is dynamic—making their task complicated, if not impossible. The most powerful contributor to map confusion is the steady growth of the national security state globally since 1947. Secret black budget accounts, spending, and operations, as well as deeply invasive surveillance and mind control, have resulted in much faster growth in the secret part of the economy and financial markets than in the open part. The issuance of FASAB 56 epitomizes the extent to which the secret side of the economy has institutionalized the lack of any accountability or disclosure. Meanwhile, the investment industry simply adopts the pretense that everything is fine.

When millions of global institutional and retail investors have differing values—both stated and real—and also have divergent maps of reality (which often also diverge from actual economic reality), the application of ESG criteria can be not only quite messy but quite fractious as well.

It is like a symphony orchestra trying to play in the dark, with each player having a different score.

In any system of laws, regulations, contracts, and transactions, someone needs to enforce. In the investment world, capital only flows into an activity where enforcement is possible. Good enforcement is an essential part of achieving successful investment returns.

One of the key questions under any governance system is, therefore, "Who enforces?" The central banking-warfare model that has defined the global economy for the last 400 years depends on military and other forms of government enforcement. The central banks print currency—and the government (with both military and intelligence arms) makes sure people use it. Ultimately, the model relies on force to make the currency and monetary system go.

In theory, the more a society can depend on culture to enforce, the less need for expensive enforcement. Years ago, my Bible class teacher asked me to explain the Solari model. When I did, she responded, "Oh, you are making it much too complicated. It's in Leviticus. It says we have to take care of the land, of each other, and of ourselves." The more we do, the less we need police to write speeding tickets or jails to lock up troublemakers.

Unfortunately, reliance on culture for enforcement is shrinking, while spending for military, intelligence, and law enforcement—including related weapons manufacturing and IT and communication systems—continues to grow, building the largest, most powerful industry on the planet. Official defense expenditures have surpassed $2 trillion a year. These expenditures are matched by deeply invasive applications of new technologies in unprecedented public-private partnerships increasingly controlled and operated by large corporations.

A significant portion of military budgets is financed with sovereign government debt denominated in fiat currencies. Operating on this model creates financial incentives that are often win-lose between the parties, as opposed to an equity model that promotes win-win incentives. The Western world became deeply addicted to debt when the central banking-warfare model made it possible to finance wars on a "fight now, pay later" basis. As time has gone by, we also have found ways to replace many military wars with economic wars and to control through financial means. For example, consider the number of times you've heard a U.S. president use the word "sanctions" in the last two decades.

Since World War II and the emergence of the Bretton Woods global trade system, military and intelligence agencies have engaged in significant covert surveillance, operations, and warfare to engineer elections, regime change, markets, and the allocation and management of natural resources. The growth of government secrecy has been matched by an explosion of secret funding, which has contributed to a national security infrastructure that remains hidden from view and has at its disposal powerful, invisible technology. This has occasioned the emergence of the term "deep state" to refer to integrated networks of secret societies and bureaucracies that manage secret money, secret technology, and secret armies—and invariably lead back to global power centers such as the District of Columbia, Vatican City, the City of London, and other financial centers. In addition, globalization has facilitated a fusion of transnational organized crime networks, with Asian, Eastern European, and Emerging Markets criminal networks becoming more powerful players in the global markets.

Indeed, it's all in the movies. Here are several of my favorite examples:

The Good Shepard describes the role of secret societies and the CIA in the deep state.

Enemy of the State describes governmental surveillance used to centralize political and economic control.

If you have listened to whistleblowers like Edward Snowden or Solari Report interviews with retired NSA technologist Bill Binney, you will understand the extent to which this infrastructure is run by private telecommunications, information technology, social media, and defense companies that feature prominently in ESG managed funds.

Independence Day hints at the extraordinary infrastructure made possible by secret federal accounting and appropriations.

And Kill the Messenger describes CIA drug dealing during the Iran-Contra period and the media role in covering it up.

Questions about secret funding have grown, as frustrated auditors have repeatedly failed to account for expenditures in the U.S. Defense Department and NATO and missing money at HUD—and mortgage fraud has resulted in trillions in bailouts.

https://www.youtube.com/watch?v=Aupqwx6vaCs

With over $24 trillion in bailouts and $21 trillion missing from U.S. accounts, the U.S. government has now implemented FASAB 56, claiming to authorize secret books. This is a process that The Solari Report has covered extensively as the "financial coup d’état."

In the 1990s, I led a joint venture between my company and the Department of Labor. Working with a group of public and corporate pension fund leaders, we looked at the advisability of economically targeted investments designed to help selected neighborhoods, primarily in the U.S. We concluded that the necessary reform was to convert U.S. government investment and spending by place—in 3100 counties around the country—to a positive return on investment from a negative return on government investment. Increasingly, we found that government investment was organized to subsidize covert operations, central control, and the stock market—as opposed to optimizing local economies. Trying to solve the resulting waste and inequality by asking private investors to address the symptoms of government waste and criminality was not a good use of private capital.

Inspired by the extraordinary wealth-creating possibilities of reengineering government investment at the local and county levels, I created a software tool to make government investment by place transparent. The U.S. government did not like that plan. They raided the company's office, seized the software, and kept it under court control for six years. When I finally was able to get it back, I discovered the most valuable pieces were missing. By that time, however, movies like Enemy of the State had educated me to the fact that players who control the local economy in 3100 counties control the federal credit. And that control enables those players to engineer market share from small business to big business. Globalization was upon us, and the profits flowing from centralization were glorious for those involved.

This is one of many reasons why it is so important to understand what globalization was about from the beginning. And no one did a better job of explaining what would happen after the U.S. adopted the latest GATT Round and launched the World Trade Organization than Sir James Goldsmith in 1994.

ARVE error: Invalid URL in url

Globalization created a Harry Potter world in which the "witches and wizards" had access to institutional capital and government credit, and understood how to engineer huge and hideous capital gains for themselves and their syndicates. This left the "muggles" to struggle to survive as their small businesses operated with a 20 times greater cost of capital in neighborhoods overrun by mortgage fraud and surveillance capitalism.

Nothing has changed since that project in the 1990s. If government investment is engineered to serve political goals, including centralization of control—much of it through large corporations, banks, and financial institutions—and that is resulting in environment damage, inequality, and corporate monopolies, why do we think that ESG disclosure and investment by the perpetrators and their monopolies will improve our situation?

If we want to apply ESG criteria to investment, then we must address the fundamental role of government and the national security state, including secret money, secret armies, and secret societies. That means that concerns about the climate impact of cattle need to be compared with the impact of F-35s, global spraying, HAARP, weather manipulation, and nuclear testing. We cannot have an intelligent conversation about the environment in a world where the majority of the planetary balance sheet operates behind a wall of government secrecy and uses force to command an extraordinary amount of planetary resources while operating at a negative return on investment to citizens and taxpayers. Indeed, the degradation of the environment is the proof that government returns are systematically negative.

Author Thierry Meyssan at the Voltaire Network has spoken eloquently about efforts to shift environmental problems away from governments and onto individuals:

The tree that hides the forest

In international summits, no one attempts to assess the energy cost of the wars in Afghanistan and Iraq, including daily airlifts to transport United States logistical support to the battlefield, including the soldiers' rations.

No one measures the living areas contaminated by depleted uranium ammunition from the Balkans to Somalia through the Greater Middle East.

Nobody mentions farmland destroyed by fumigation as part of the war on drugs in Latin America and Central Asia; nor those sterilized by the spraying of Agent Orange, from the Vietnamese jungle to Iraqi palm groves.

Until the Cochabamba conference, the collective consciousness has obviously forgotten that the main environmental damage is not the consequence of particular lifestyles or civil industry but corporate wars to allow multinationals to exploit natural resources, and the ruthless exploitation of these resources by the multinationals to supply the imperial armies. Which brings us back to our starting point, when U Thant proclaimed "Earth Day" to protest against the Vietnam War.

The existing central banking-warfare model is reaching a crossroads. Sovereign debt as a percentage of GDP is at significant levels and rising. More than a few governments, including the United States, are effectively in a debt spiral. In addition, the credit quality of numerous governments is threatened by a breakdown of the Treaty of Westphalia system that developed with the central banking-warfare model—that a government would maintain a monopoly on force within its jurisdiction. The privatization of force into mercenary armies and banks, defense companies, and private corporations that can field private armies signals the end of government monopolies on force within their jurisdiction.

If the Mexican army is defeated by drug cartels and has to concede municipalities to the cartels, what are the implications for Mexico's sovereign bond holders?

Growing amounts of debt, spending the proceeds of debt, taxation in secret and in a manner that has a negative return on investment, and the breakdown of the Treaty of Westphalia system—all of these are signs that the failure of the central banking-warfare model without a sensible replacement is the 800-pound gorilla in the ESG universe.

Thus far we have identified challenges that include differing values and maps and a reluctance to address the negative returns resulting from some governments' and central banks' operations. Challenges also include the differing goals of various ESG efforts. It would be wonderful if everyone's aims for the application of non-financial disclosure were well-intentioned, but they are not. Let's look at some of the goals at play.

1. Marketing

The millennial generation is clearly frustrated with environmental degradation, inequality, and government and corporate corruption. Consequently, attention to ESG criteria presumably will attract younger people as customers, employees, and investors who are interested in greater system-wide responsibility and performance.

2. Privatization

There is a push to outsource more government operations and responsibilities to private companies and financial institutions. The more that corporations come to be considered socially responsible and capable of thinking "ecosystem wide" and long-term, presumably the more the body politic will accept increased privatization. The marketing of privatization must override the fact that, certainly in the United States, the more dependent governments become on private companies, the more money goes missing and the more civil society deteriorates; taxpayers also will likely pay more in taxes and enjoy fewer employment opportunities when private corporations and financial institutions take over functions formerly provided by government. Note that the corporate ESG hoopla has been matched by an effort in both the corporate and independent media to criticize and diminish the importance and reputation of government employees and the civil service.

Unfortunately, in some cases, ESG is being used to market the adoption of fascism—the fusion of corporations and government into a non-accountable state.

3. The Best Defense Is a Good Offense

Large multinationals have had quite a run over the last two decades as globalization allowed a great deal of free reign. Taxation is a perfect example. Large multinationals were able to shift revenues and operations between jurisdictions—arbitraging tax treatments, engaging in transfer pricing, and enjoying the full benefit of offshore systems. Now a backlash is building, not unlike the backlash against Monsanto. Governments are cooperating to protect their revenue flows. The business press and some of the more far-sighted investors are concerned about the growing monopolistic behavior by large corporations that benefit from political largess and bailouts at the same time that productivity is falling. As we described in the 2nd Quarter 2016 Wrap Up, falling productivity can and will destroy a society. Falling productivity is proof that the current model is not working.

This backlash is growing as the global Bretton Woods trade system established after World War II unravels. Political campaigns are looking for scapegoats and entertaining a growing number of radical proposals. Embracing ESG is a way of trying to white-out complicity and get ahead of the backlash while establishing a brand concerned about solving social and economic ills.

Senator Warren's efforts—in concert with a group of the largest pension fund investors—to promote SEC disclosure on climate change at the same time the Congress and White House were adopting FASAB 56 are no accident. It is political whiteout of the first order. Senator Warren is assisting in the permanent destruction of traditional disclosure that will significantly benefit the institution that employed her for many years: the Harvard Corporation.

4. Technocracy

The global leadership believes that information systems will make it possible for them to replace markets and democratic processes with technocracy—essentially managing individuals with complex surveillance and control systems highly dependent on AI and software. Using climate change to layer on more complicated rules and regulations (not to mention the onerous taxes that may be ushered in with them) is a leading technique for making technocracy go. Although adding layers of rules and regulations is expensive (as is the related enforcement and litigation), these expenses typically can be amortized by large enterprises, which can overwhelm and bankrupt small businesses and farms and independent professionals and their practices. Used in this manner, ESG can and will facilitate increased centralization of economic activity.

The rollout of technocratic systems looks different in various countries. However, whether it is the "yellow vests" in France, farmers in the Netherlands, Belgium, and Germany, street protestors in Hong Kong, or the "deplorables" who voted for Trump and Brexit, we are seeing a wholesale rejection of central control and its assault on highly productive small businesses, small farmers, property rights, and freedom of speech. Millions of people are prepared to change to protect their environment and their culture, but they are not willing to endure lawlessness, corruption, and the intentional destruction of their productivity and savings to support central control.

5. Aligning Investments with Values

In contrast to the technocrats, many financial professionals understand the power and potential of integrating our values with investments and our use of resources. They are quite sincere about helping companies and investment managers look across the full range of their impacts to improve risk management and productivity. They are looking to find common ground and support from those interested in providing resources, no matter the difference in goals. This group of professionals offers an opportunity to make ESG meaningful, particularly if they are willing to grapple with the negative returns of central control rather than help central control grow.

Global populations continue to grow. With globalization, the global middle class is growing, too. Consequently, pressure on resources and resource depletion continue. Climate change is being used as a way of marketing or requiring reduced individual resource use—at the very same time that many governments find themselves not in a position to deliver on their retirement and social safety net promises and facing concerns about increased costs of household goods resulting from aggressive monetary and fiscal policy. The climate change push includes an effort to use Agenda 21/30, financial and regulatory manipulation, and disaster capitalism to drive people from the countryside into high-density cities where they will be subject to much greater central dependency and control.

Understanding the basic facts of resources and resource use is essential for any ESG effort—including the statistics of people, resources, and unfunded liabilities—yet it is difficult and time-consuming to accomplish. One of the critical wildcards has to do with the possibility of breakthrough energy solutions over the next few decades.

We live on a planet where the real governance system is invisible. In the absence of reliable disclosure, my nickname for the governance system is "Mr. Global." The financial system is one of the primary tools used by Mr. Global to manage in an invisible manner. This includes the fiat currency and debt systems described above. Consequently, at the heart of this system is what some economists call "unsound money." My favorite comment on this aspect relative to ESG comes from Reg Howe's award-winning essay, "The Golden Sextant":

The invisibility of the governance system has been exacerbated by the rise of index funds. These funds have centralized a significant portion of capital into the hands of a small number of investment managers and stripped the financial market of what was once a large number of research analysts who kept a sharp eye on basic financial disclosure and policed bad behavior. The disappearance of this research capacity has contributed to the U.S. capital markets going "dark."

Again, for ESG to be meaningful, it needs to promote basic transparency regarding our governance and financial systems and must address the fundamental unsoundness of the current model. Layering on greater complexity without discussing or addressing these issues will likely foster a system that helps corporate monopolies further control resources.

VI. An Example—JPMorgan Chase & Co.

"To the victor go the spoils." ~English saying

A. Introduction

The fact sheets for SRI and ESG mutual funds and exchange-traded funds (ETFs) typically list their top ten holdings. For many years, I have observed JPMorgan Chase & Co. (ticker = JPM) as a common holding in these top ten holding lists. I reviewed holdings for the top SRI and ESG funds for the 3rd Quarter 2016 Wrap Up and then again for this 1st Quarter 2019 Wrap Up. Although JPMorgan appears to have diminished in prominence, this could reflect financial and market conditions unrelated to ESG objectives. Overall, JPMorgan continues to have a significant presence in current SRI and ESG fund holdings.

I was inspired to consider JPMorgan for my lead example in this ESG discussion after hearing an impressive presentation by JUST Capital. JUST Capital polls U.S. citizens to determine the values important to them and then applies those values to ranking U.S. companies that are the most "just." In an online webinar, JUST Capital described JPMorgan's inclusion in its index used for the Goldman Sachs JUST Large Cap Equity ETF (ticker = JUST). JPM is currently the fourth largest holding.

In its 2019 Rankings, JUST Capital ranked JPMorgan as 111th of 890 companies and 3rd of 47 banks. JPMorgan won an overall score of 57.2 despite the fact that its ranking for customers ("fair treatment of customers, including privacy and honest sales terms") was 852 of 890 companies and despite a ranking of 853 of 890 companies for products ("products and services should be high quality, fairly priced, and beneficial to society"). (In JUST Capital's 2020 Rankings, released on November 12, 2019, the rankings changed slightly—but JPM was still 886 out of 922 companies for "how a company treats its customers.") See more at JUST Capital's website.

JPMorgan's financial shenanigans are well-documented, as is its association with U.S. banking industry activities destructive of economic productivity and supportive of centralizing wealth. If ESG can so easily and quickly redeem JPMorgan, then ESG has the potential to become the financial equivalent of the Men in Black's Neuralyzer.

Consequently, JPMorgan seems an ideal choice to demonstrate the incoherence in the current application of ESG criteria.

B. Overview of JPMorgan

JPMorgan is the largest U.S. bank in terms of both asset size ($2.7 trillion) and market capitalization ($400 billion). It is the sixth largest bank in the world in asset size—behind four larger Chinese banks and one larger Japanese bank—and the largest in the world by market capitalization. According to the Nilson Report, JPMorgan is the second largest U.S. credit card issuer, with purchases falling slightly behind American Express.

According to its most recent annual report, JPMorgan has annual net revenues of $109 billion, net income of $32.5 billion, a return on common equity of 13%, and 256,105 employees.

Its strategic position relative to government puts it at the very center of the financial train tracks of the global financial system.

The New York Fed, the most powerful of the 12 banks of the U.S. Federal Reserve System, is a private bank that serves as depository for the U.S. government. It provides the federal bank accounts and uses its members to do so. The New York Fed is owned by its members—of which JPMorgan is the largest and most powerful. When I contacted the New York Fed years ago to ask whether its members had access to its data flows and intelligence, it informed me that that information was confidential. As one retired Drug Enforcement Agency agent told a reporter I was working with, "All the wires are batched and run through the New York Fed. Let's face it, they know where every penny is."

The New York Fed serves as the agent to the U.S. government in management of the Exchange Stabilization Fund (ESF), reporting directly to the Secretary of the Treasury—again using its member banks for implementation of ESF operations. The New York Fed also implements domestic market operations reflecting the Fed's monetary policies. For an overview of the laws related to the creation and operation of the U.S. Federal Reserve, see the Special Solari Report "The History and Organization of the Federal Reserve: The What and Why of the United States' Most Powerful Banking Organization."

U.S. government operations are deeply dependent on JPMorgan, whether in the latter's role as a dominant party in the ownership and control of the New York Fed or as a dominant party in implementation of operations for the New York Fed's depository, ESF, and market operations. In my experience as Assistant Secretary of Housing, this reliance on JPMorgan led to the bank having many other responsibilities and contractual relationships with federal government agency financial operations, such as mortgage servicing at Ginnie Mae at HUD. For many years, JPMorgan Chase served as a leading foreclosure agent and manager for the FHA/HUD foreclosure and property management system. JPMorgan Chase—when last I looked—also ran the Food Stamp payment systems for 37 U.S. states, outsourcing its data servicing and customer service to India.

In addition, these relationships extended to significant banking, lending, and underwriting relationships with state and local government. One Houston attorney explained to me that all of the housing bonds they issued using HUD Section 8 subsidy were required to use JPMorgan as trustee.

JPMorgan's relationships also extend internationally, with significant correspondent banking relationships. According to its website, "In December 1947, at the invitation of U.S. military authorities, Chase Manhattan Bank established the first U.S. postwar bank branches in Frankfurt and Tokyo. They joined the London and Paris branches and were soon followed by others around the world. In the 1970s alone, Chase added nearly 40 international branches, representative offices, affiliates, subsidiaries and joint ventures. The bank executed two historic firsts in 1973: opening a representative office in Moscow, the first U.S. bank presence in Russia since the 1920s; and becoming the first U.S. correspondent to the Bank of China since the 1949 revolution."

A South African executive once explained to me that all funds in and out of the country had to go through JPMorgan as lead correspondent bank. I have not confirmed that statement but mention it as I was struck by his assumption that JPMorgan controlled the primary financial transaction train tracks in and out of the country. In essence, JPMorgan had a financial kill switch.

JPMorgan has played a significant role in the SWIFT payment networks and the design and management of significant payment networks globally. This means that it plays an important role in the implementation of U.S. Treasury economic sanctions—a critical strategy for U.S. geopolitical power and financial control globally.

Along with Citibank, JPMorgan has been the leader in developing the OTC derivative market, with total notational derivatives of $47 trillion at the end of 2016. I have long believed that a significant portion of this position was as agent for the ESF; hence, it is a position for which the U.S. Treasury is entirely liable. Given the role of derivatives in the management of the gold market and various commodities markets, and the role of interest rate swaps in management of interest rates, JPMorgan's role in market interventions is more than significant. There has been much criticism of JPMorgan's role in these interventions, including serious questions about legality, ethics, and the destructive consequences of market manipulation for productivity and various economies.

JPMorgan is a primary dealer—one of 24 firms that facilitates the marketing and distribution of U.S. government securities. I am sometimes asked by subscribers and clients why the government does not do a better job of regulating JPMorgan. My response is simple. It is extremely difficult to separate the New York Fed, the U.S. Treasury, and JPMorgan Chase. Their operations are highly integrated and deeply interdependent. The conflicts of interest are substantial in number and size. Imagine a regulator who is highly leveraged and deeply financially dependent on the entity it is regulating. That is going to be a very timid regulator.

JPMorgan is also a major asset manager. eVestment's global database at the end of 2018 listed J.P. Morgan Investment Management Inc. as the seventh largest, with nearly $1 trillion of assets under management. (BlackRock was the largest with $3.6 trillion, followed by second largest Vanguard with $3.1 trillion.)

For more information on JPMorgan, I recommend a review of their SEC filings available at the Investor Relations section on their website. Here is a direct link to their annual report and proxy statement.

C. JPMorgan: Questionable, Unethical, and Illegal Activities

Having chosen JPMorgan to demonstrate the challenges of applying ESG in the current environment, I assigned a researcher to spend several weeks making a table listing recent regulatory and litigation settlements with JPMorgan. From open sources, they were able to identify 69 settlements totaling approximately $42 billion (or approximately 130% of the bank's 2018 net income) from approximately 2002 to 2019 (with the majority subsequent to 2008). I would encourage you to review the table to get a sense of the magnitude of JPMorgan's questionable, unethical, and illegal activities during the period.

Table: JPMorgan Chase: Selected Legal, Regulatory, and Enforcement Settlements, 2002 to Date

[table id=6 /]

The chief of staff to the Senator who chaired the appropriations committee that included HUD once complained to me, "HUD is being run as a criminal enterprise." While I agreed with that statement, I can assure you it was made possible by JPMorgan running the HUD accounts, servicing, and foreclosures for which they were responsible as a criminal enterprise.

Sitting back and reviewing the settlements that have been made public, it is hard for me to find a better description than "criminal enterprise." With the mortgage bubble engineered throughout the Clinton and Bush Administrations followed by $24 trillion of bailouts, JPMorgan made a small fortune and used settlements to kick back a portion to their partners in the federal government. Speaking as the former Assistant Secretary of Housing and former lead financial advisor to the FHA/HUD, engineering the mortgage bubble required significant intentional leadership by the U.S. Treasury, HUD, the New York Fed, and the New York Fed member banks. This was an orchestrated financial coup d’état. Although JPMorgan was far from alone, its role was significant.

The engineering of the U.S. housing and mortgage bubble in the 1990s was a devastating turn of events for the American people. Lulled by the false prosperity of easy money, Americans borrowed liberally for education and homes, not appreciating that the globalization being financed by JPMorgan and the banking industry would dramatically reduce their ability to repay that debt. In addition, the traditional usury and consumer protections to prevent fraudulent inducement and predatory lending were changed as college tuitions and consumer interest rates skyrocketed. The harvest was on—and JPMorgan Chase profits did nothing but rise. Thanks in part to the repeal of key provisions of Glass-Steagall and extraordinary lobbying during the financial crisis, the people drained in the harvest found themselves on the hook as taxpayers for the banking industry mess. The ultimate bailouts totaled $24 trillion. On all accounts, JPMorgan made out like a bandit.

While there are numerous examples of JPMorgan's socially irresponsible conduct leading the financial system during the last two decades, I will focus on two.

First, $21 trillion has gone missing from DOD and HUD since fiscal 1998, as documented in our 2018 Annual Wrap Up: The Real Game of Missing Money. We do not know what portion of those transactions went through federal bank accounts at JPMorgan. We do not know what securities were fraudulently or secretly issued through JPMorgan. We do not know what portion of those transactions reflect securities operations by JPMorgan on behalf of the ESF or other Treasury funds. What we do know is that we have a significant number of transactions that are in violation of the U.S. Constitution and federal financial management laws and that JPMorgan—as a shareholder of the New York Fed and a bank and securities dealer—continued to transact and finance the federal government while making extraordinary profits at essentially (as proved by the bailouts) little or no risk.

I am often asked why I bring up the missing $21 trillion if it is not possible to get the money back. I do not agree that it is impossible to get it back. The Department of Justice has historically supported a theory of common right of offset in which a government contractor is legally responsible for government losses and opportunity costs. Given JPMorgan's assets and earning power, it is obvious they and the responsible officers and board members have the capacity to return some or all of the portion of the illegal transactions for which JPMorgan was responsible.

Thanks to FASAB 56, however, we are now in a world where we will have no idea how much money is going missing from federal agencies. This means that JPMorgan will continue to distribute U.S. Treasury and related securities, or purchase them in their asset management operation, knowing that the federal government is operating on essentially a criminal basis—having negated basic disclosure in a major portion of the U.S. securities market. JPMorgan also appears to have done nothing when the government threatened the very existence of any rating agency that lowered the U.S. federal credit.

The second is the Madoff Ponzi scheme. The person who has provided us with the most compelling case study of JPMorgan's business model is the brilliant New York attorney, Helen Chaitman. Chaitman is the author of a book and website co-authored by Lance Gotthoffer, titled JPMadoff: The Unholy Alliance between America's Biggest Bank and America's Biggest Crook.

Helen joined me on The Solari Report to discuss her experience litigating on behalf of the victims of the Madoff Ponzi scheme:

Solari Report: JP Madoff with Helen Chaitman

In our interview, I learned that Madoff's investment operation had only one bank account from the mid-1990's until he was arrested. That bank account was at JPMorgan. I asked Helen who the securities custodian was. She explained that there was none, as no securities had been purchased. Indeed, billions had sat at JPMorgan uninvested or transferred through JPMorgan to a variety of beneficiaries of the Ponzi scheme. In short, JPMorgan had known that the Madoff investment operation was a Ponzi scheme all along. I remember commenting to Helen, "JPMorgan was the senior partner." JPMorgan was the controlling partner for more than a decade in a $60 billion Ponzi scheme. Indeed, if you look at our table, you will see a major settlement by JPMorgan for its role in Madoff.

As I look across the numerous roles played by JPMorgan in market manipulations, Ponzi schemes, and trillions in money missing from the U.S. government or spent through the bailouts, I find it difficult to find a description for their business model other than criminal enterprise.

And yet a significant number of SRI and ESG institutional investors disagree. Indeed, JPMorgan has committed major resources to documenting how much it cares about social and community responsibility. If you have studied JPMorgan's involvement in a wide variety of shenanigans, you will find their responsibility reports a shining example of corporate creativity.

Corporate Responsibility Report 2018: Return on Community

Environmental, Social & Governance Report 2018

Unfortunately, JPMorgan's positive return on equity depends on running the U.S. government at a deeply negative return to taxpayers with a spiraling U.S. treasury debt and liabilities problem and out-of-control fiscal spending and monetary printing. The resulting JPMorgan profits finance a small trickle of token projects that are indeed heartwarming. However, they do not change the fundamental nature of the business model. Twenty-one trillion dollars is still missing. Students throughout America still do not have access to bankruptcy. Credit card holders are still paying 12%-30% on their credit cards while JPMorgan is using federal credit to borrow for next to nothing. It used to be called usury. It used to be illegal.

If an SRI, ESG, or Christian investor is investing funds in JPMorgan, then they are not serious about ethical investment or they do not understand how the world works. Or both.

VII. Turning the Red Button Green

"We take on some of the most dangerous myths currently being pushed surrounding issues of climate, environment, 'greening' and unmask some of the dirty politics and global control measures behind it. What is happening is not just bad policy-making, but a psychological warfare aimed at the population, and especially the younger generations… and people must see it for what it really is." ~Aaron and Melissa Dykes, Truthstream Media

For those of you who are serious about using ESG to turn the red button green, here are suggestions to help you think through successful applications.

Let's get the basics right. There is no sense in requiring an investment in non-financial disclosure if we are corrupting and ignoring basic financial disclosure. Hold companies and governments accountable to provide transparency about operations and reliable and accessible financial disclosure. We will not achieve any ESG goals without excellence in traditional disclosure standards.

Real solutions require a proper diagnosis of real problems. Whatever ills we seek to address—whether environmental deterioration, inequality, or falling productivity—we need an accurate diagnosis of who and what is causing the problem. This is why secrecy is so harmful and transparency along the lines of traditional disclosure standards is so important.

Our governance model on Planet Earth is secret—let's bring transparency to it. How can we identify or implement real solutions when we are playing in the dark? Why do we not know who is in control?

This raises many of the risk issues we face as a society. Why are the people who run governance—whoever they are—working so hard to centralize political and economic control? What are the risk issues they are managing? How do we reduce their risks so they can operate on a more transparent basis?

Our analysis needs to look at population and demographics, resource use, and the introduction of new technologies on an unregulated basis. Why is planetary leadership in a rush to build a multiplanetary civilization? Why are they replacing markets with centrally controlled technocracy in defiance of existing laws and without popular understanding and support?

The central banking-warfare model is breaking down. That means there are numerous aspects that must be addressed.